Shareholders ask Ubisoft management to sell the company to Tencent

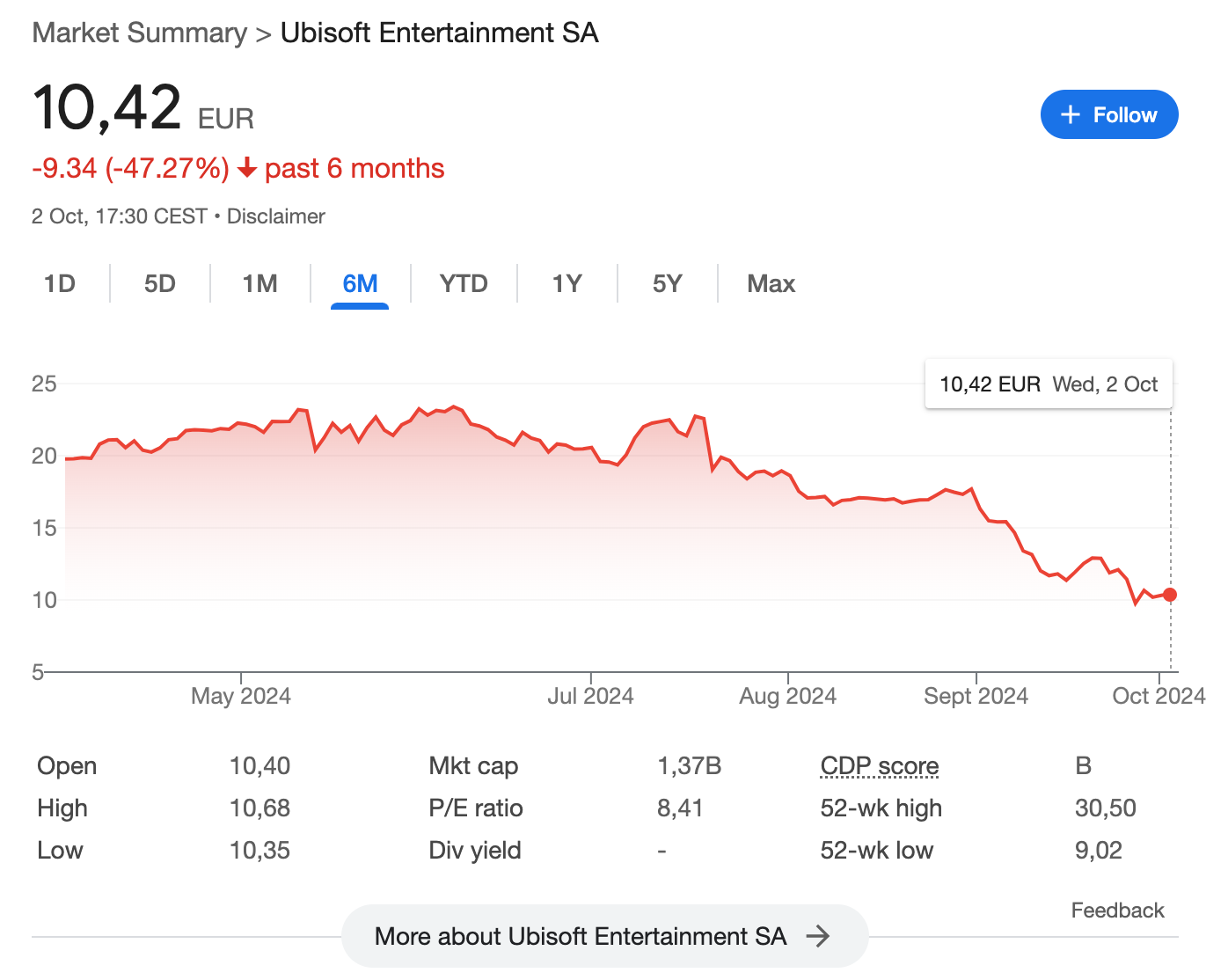

Against the backdrop of the largest drop in Ubisoft's securities value in the last 10 years, some shareholders are urging the management to sell the company to private investors or Tencent, which owns 10% of Ubisoft shares.

The most active in advocating for the sale of the company is the Slovak hedge fund AJ Investments, which owns about 1% of Ubisoft shares. AJ Investments has already secured the support of 10% of shareholders.

AJ Investments noted that next Tuesday it is scheduled to speak with Ubisoft management to discuss its proposals. If necessary, representatives of the hedge fund are even ready to stage a demonstration outside Ubisoft's office.

Deutsche Bank, which previously downgraded Ubisoft's stock rating from 'buy' to 'hold,' stated that the company's forecast cut was 'more than expected' and that the delay in the release of Assassin's Creed Shadows 'pushes a significant amount of revenue' to the next fiscal year.

Deutsche Bank also lowered its sales forecasts for Assassin’s Creed Shadows from 8 to 7 million copies over 12 months.